Out Of This World Tips About How To Find Out How Much Tax You Have Paid

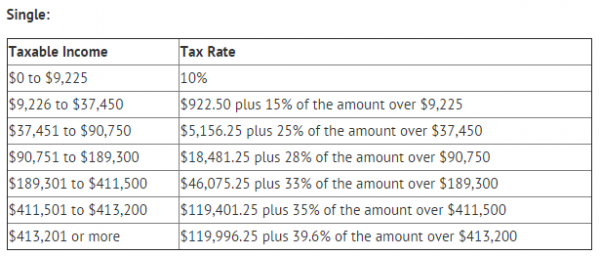

Estimating a tax bill starts with estimating taxable income.

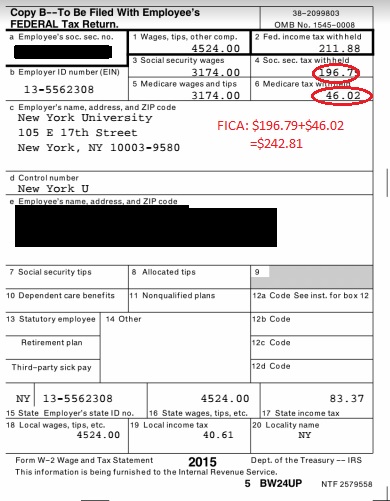

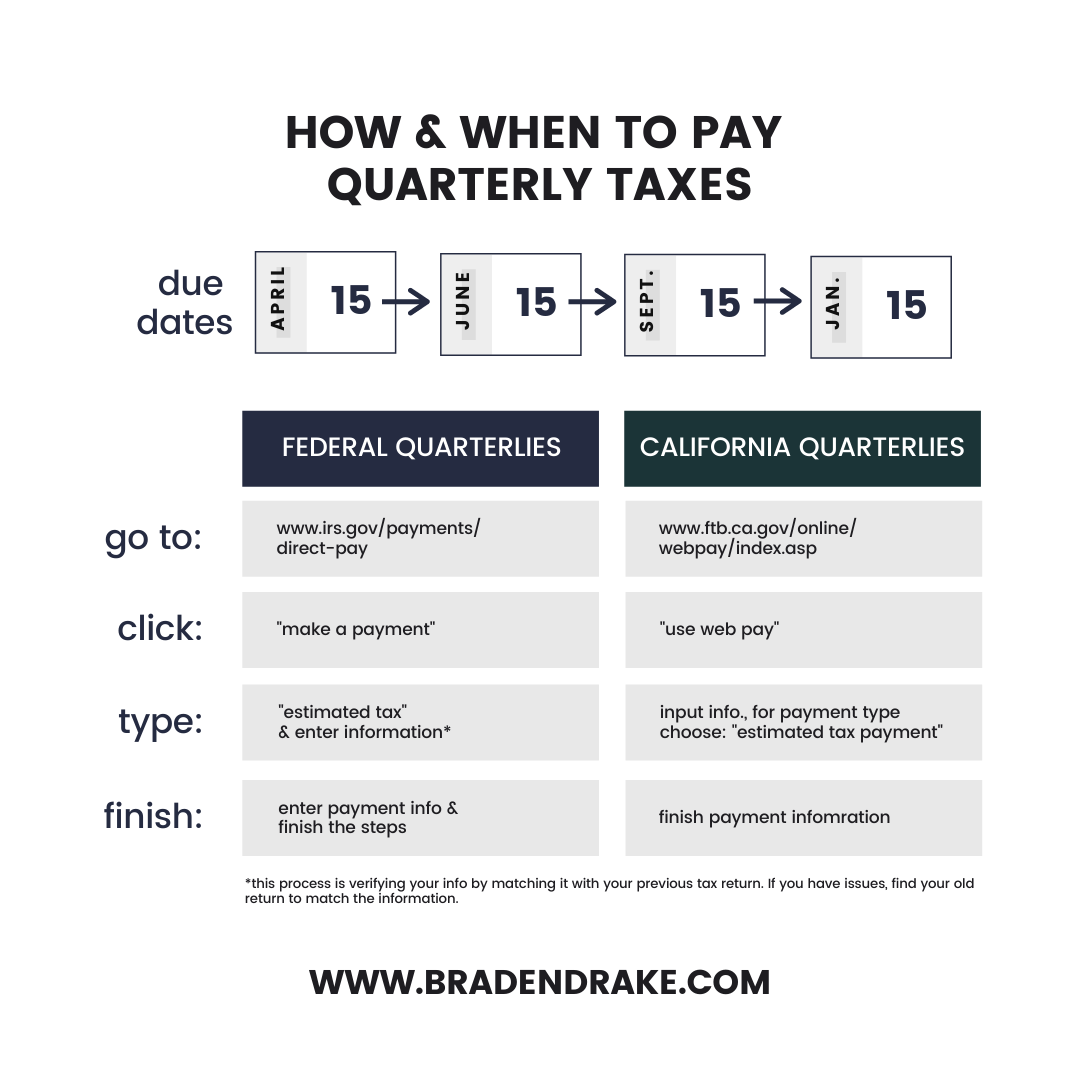

How to find out how much tax you have paid. Your p800 or simple assessment will tell you how to get a. Use our 1040 income tax calculator to estimate how much tax you might pay on your taxable income. View the amount they owe.

Check how much income tax you paid last year (6 april 2021 to 5 april 2022) estimate how much income tax you should have paid in a previous year if you cannot use these services, you can. What’s left is taxable income. (after salary sacrifice, before tax) employment income frequency.

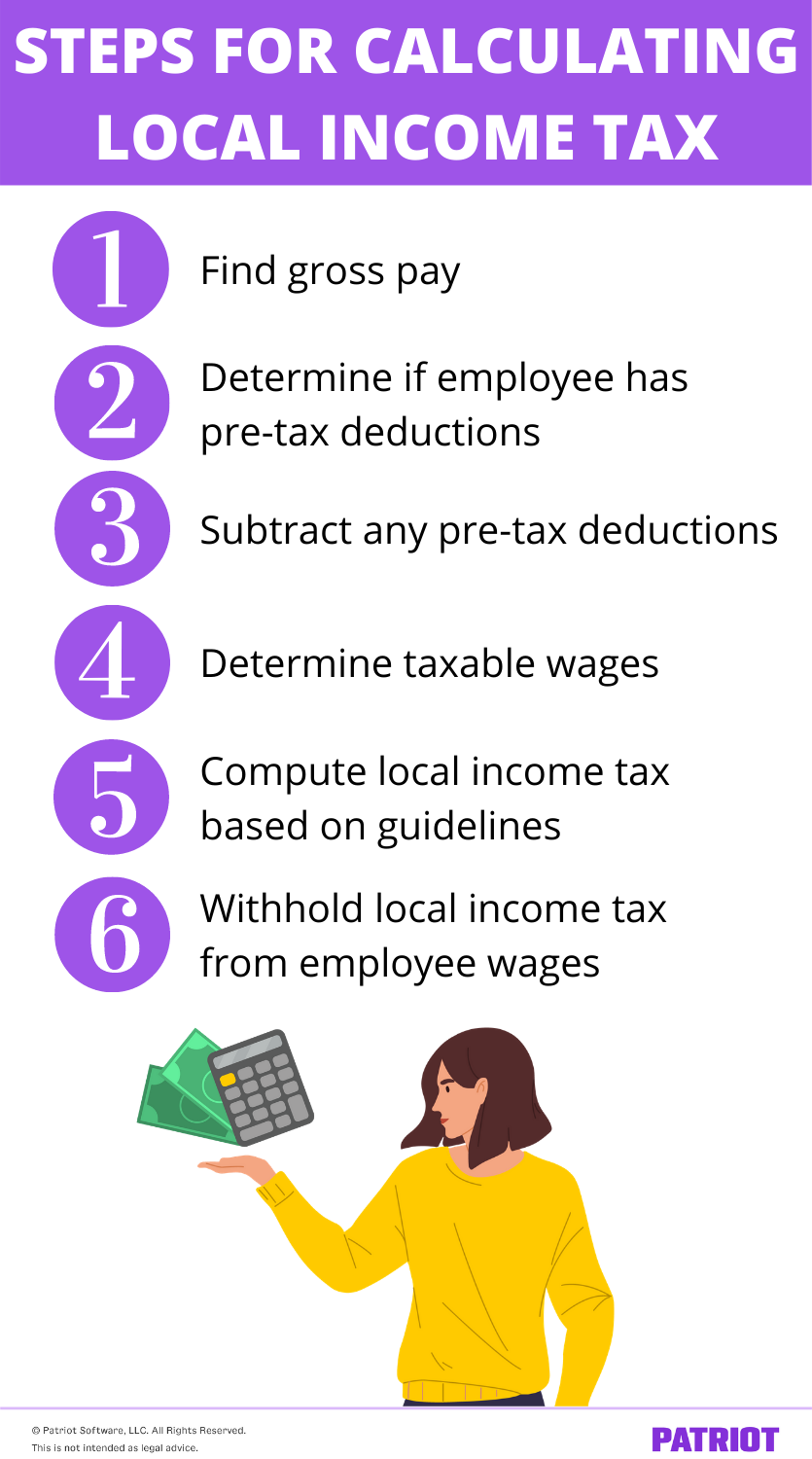

The amount of state and local income tax you pay will depend on how much income you earn and the tax rate of the state or locality where you live. Enter an income to view the. Check how much income tax you paid last year once your income tax has been calculated, you can use this service to check how much you paid from 6 april 2021 to 5 april 2022.

Here are some ways to figure it out: Form 26 as is your annual tax statement. If you have not paid the right amount at the end of the tax year, hmrc will send you a p800 or a simple assessment tax calculation.

You’ll need your most recent pay stubs and income tax return. Check box 10 (other) on form 1098 from your mortgage company review your bank or credit card records if you paid the property/real. Naturally, you are free to replace 20% in the above formulas.

Tell hm revenue and customs (hmrc) about changes that affect your tax code update your employer or pension provider details see an estimate of how much tax you’ll pay over the. Before you start, you should know the total amount youve paid for as well as the amount of tax paid. Subtract the tax paid from the total amount.